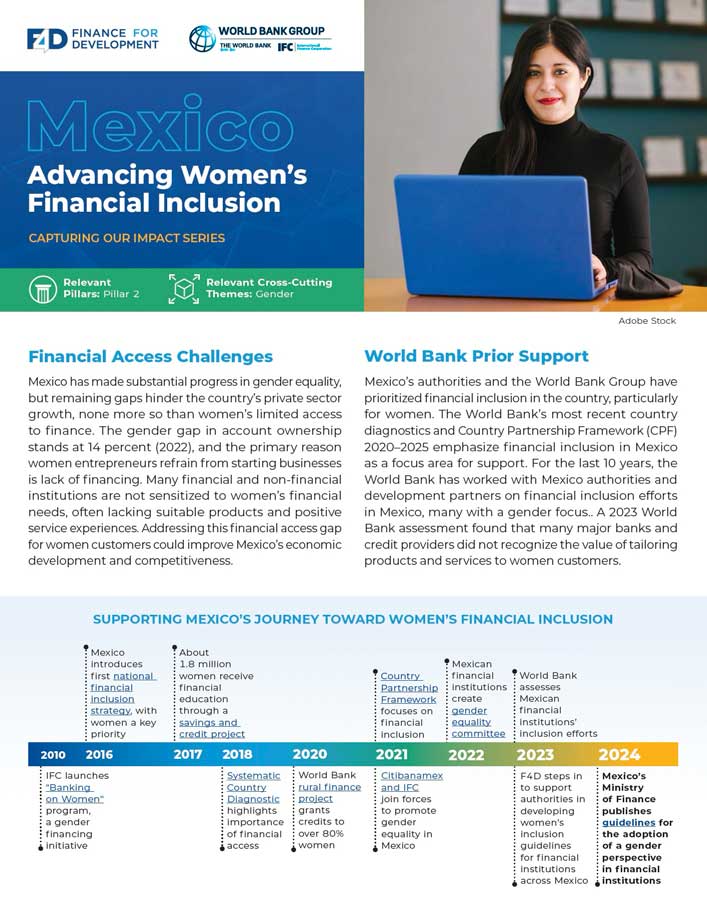

2010

IFC launches the Banking on Women program, a gender financing initiative

Mexico has made substantial progress in gender equality, yet remaining finance gaps for women and women-owned businesses are limiting the country's private sector growth and economic development.

Mexico has made substantial progress in gender equality, but remaining gaps hinder the country’s private sector growth, none more so than women’s limited access to finance. The gender gap in account ownership stands at 14 percent (2022), and the primary reason women entrepreneurs refrain from starting businesses is lack of financing. Many financial and non-financial institutions are not sensitized to women’s financial needs, often lacking suitable products and positive service experiences. Addressing this financial access gap for women customers could improve Mexico’s economic development and competitiveness.

Mexico’s authorities and the World Bank Group have prioritized financial inclusion in the country, particularly for women. The World Bank’s most recent country diagnostics and Country Partnership Framework (CPF) 2020–2025 emphasize financial inclusion in Mexico as a focus area for support. For the last 10 years, the World Bank has worked with Mexico authorities and development partners on financial inclusion efforts in Mexico, many with a gender focus. A 2023 World Bank assessment found that many major banks and credit providers did not recognize the value of tailoring products and services to women customers.

Mexico's Ministry of Finance publishes guidelines for the adoption of a gender perspective in financial institutions

— Dr. Alfredo Navarrete Martínez, Head of the Banking, Securities and Savings Unit, Ministry of Finance

Building on prior World Bank engagements in Mexico and the financial sector assessment, in 2023, F4D stepped in to support authorities in the development of the first guidelines for adoption of a gender perspective across financial institutions. The project team included staff from the World Bank, CGAP, and IFC, leveraging their cumulative expertise on women’s financial inclusion issues in collaboration with Mexico’s Ministry of Finance and the CIIGEF. IFC brought knowledge of gender-sensitive strategies and product offerings of financial institutions, and the World Bank and CGAP brought knowledge of policies and interventions to advance women’s use of financial services.

In September 2024, the Ministry of Finance published the guidelines in Spanish on its web page, with endorsement by the CIIGEF. The guidelines aim to help Mexico’s financial institutions make organizational and cultural changes to integrate the intentional inclusion of women. The guidelines provide a framework that institutions can use to develop their own gender strategies.

The new guidelines are a step toward ensuring the long-term sustainability of the financial industry’s gender-sensitive business strategy and building a more inclusive and equitable financial sector in Mexico. Closing the gender gap in financial inclusion not only promotes gender equality but also enhances Mexico’s economic development and global competitiveness by tapping into the entrepreneurial talent of women, given their demographic representation and significant presence in the MSME sector.

Being a first exercise of its kind, these guidelines can transcend borders, serving as a model for other countries and regions. Mexican officials, the CIIGEF, and the World Bank will work together to share and promote the guidelines to galvanize engagement and contribute to global dialogue on financial inclusion.

Monitoring and evaluation tools can be used to track the guidelines’ impact. The guidelines include a scorecard for financial institutions to assess progress and a survey for women customers to measure perspectives.

— Karina Villanueva Aritzmendi, Director of Gender, Inclusion and Financial Education at the Banking, Securities and Savings Unit, Ministry of Finance

Download this Story